cash app venmo zelle tax

The short answer. No Venmo isnt going to tax you if you receive more than 600.

If You Use Cash App Venmo Zelle Or Paypal You Should Watch This Video I Received Money From Cash App Venmo And Paypal Should I Declare Them For Tax Purposes

1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue.

. Cash App Taxes formerly Credit Karma Tax is a fast easy 100 free way to file your federal and state taxes. A new tax rule will impact millions of small businesses in 2022. This new rule applies to paying cash app taxes including on income received through PayPal Venmo Cash App and most third-party payment networks.

Some finance TikToks are spreading misleading advice. Unlike Zelle Venmo functions as a digital wallet allowing you to accrue money in. Many TPSOs such as PayPal and Venmo and others like Cash App have separate accounts that allow users to identify which of their transactions are for goods and.

Venmo Zelle Cash App or any third-party settlement provider thats accepting credit cards on your behalf. At this time Zelle. Under the IRS new.

Starting January 2022 if you receive more than 600 from either CashApp Zelle or Venmo the IRS will be requiring you to pay taxes on that. Cash App Investing does not trade bitcoin and Block Inc. Is not a member of FINRA or SIPC.

Venmo and Zelle Tax Confusion. As of January 1 the IRS will change the. The IRS requires the payment app to send you a 1099-K by January 31 if you received more than 600 in commercial transactions during the preceding tax year.

A recent piece of TikTok finance advice has struck terror into the hearts of payment app users claiming that anyone who receives more than 600 on platforms like Venmo Zelle. New Cash App Tax Reporting for Payments 600 or more Under the prior law the IRS required payment card and third party networks to issue Form 1099-K to report certain. Venmo is a social payment app you can use to exchange funds with people and businesses.

By Jennimai Nguyen on October 21 2021. Millions of people have trusted our service to file their taxes for free and. As of Jan.

Tax files might also be challenged with some administrative issues once the rule is in effect according to the news outlet. On it the company notes this new 600 reporting requirement does not. Is wv getting another.

Cardano Dogecoin Algorand Bitcoin Litecoin Basic Attention Token Bitcoin Cash. AT the start of the New Year business owners using third-party payment processors were forced to report 600 transactions or higher to the IRS. But keep reading and we will cut through the marketing hype and dig into the details of these and other services to help you decide which online rent.

The Internal Revenue Service is cracking down on people who underreport earnings received through digital payment apps such as PayPal Venmo Cash App Zelle and others. Squares Cash App includes a partially updated page for users with Cash App for Business accounts. January 27 2022 958 AM.

Animals and Pets Anime Art. As of January 1 2022 the use of third-party payment networks such as Venmo Cash App or Zelle for transactions amounting to more than 600 per year in exchange for. USA Repay 100 11052022 PayPal Venmo Zelle Hi all.

Social media posts like this tweet that was published on September 15 have claimed that starting January 2022 if you receive more than 600 per year through third-party. For additional information see the Bitcoin and Cash App Investing disclosures 3 Cash App. Zelle and Cash App now reporting your transactions to the IRS so they can be taxed.

Venmo Paypal And Cash App Will Now Have To Report Transactions Totaling More Than 600 To The Irs Daily Mail Online

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

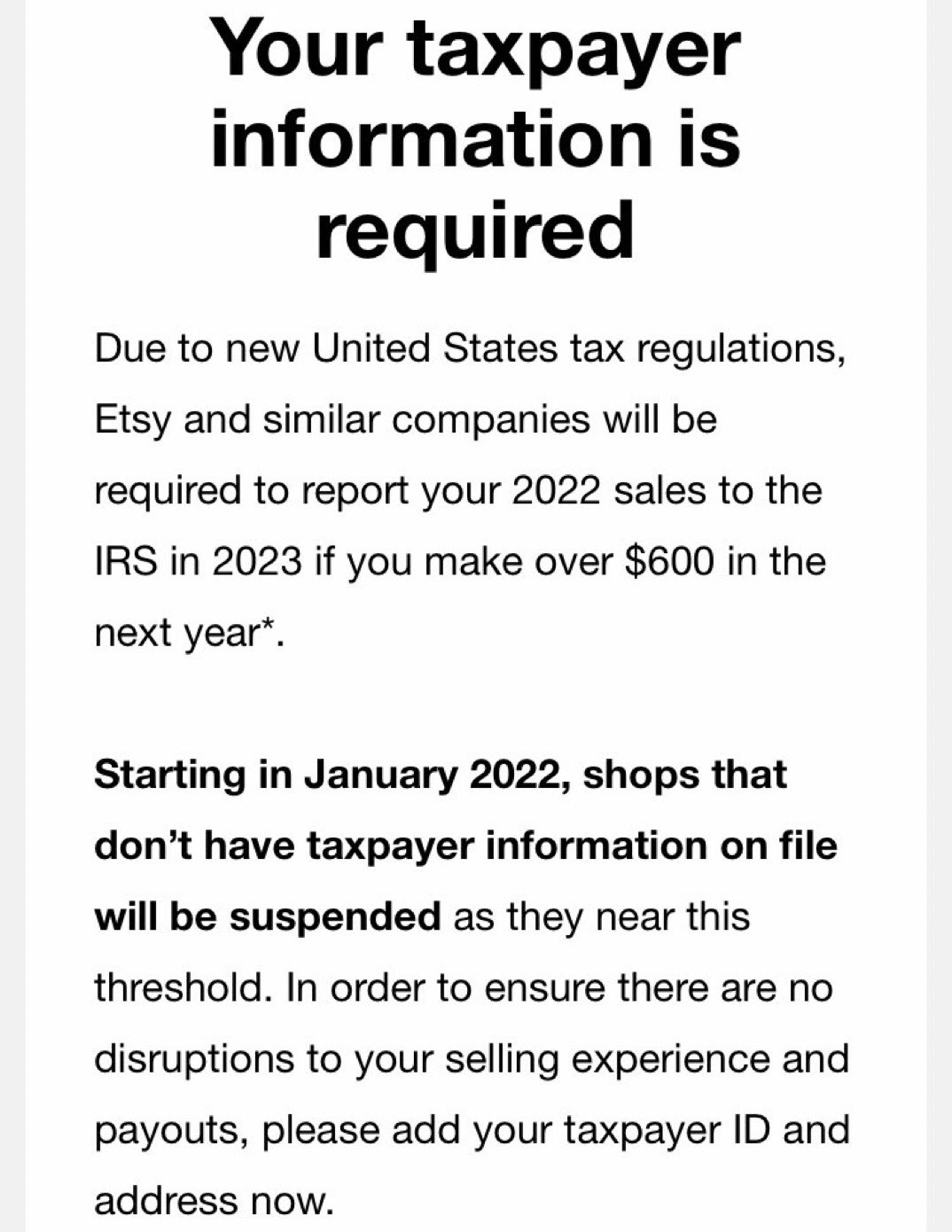

Beez On Twitter People Really Fell For Tax The Rich Campaign This New 600 Tax Law Isn T For The Rich Etsy Sellers Are Now Required To Pay Taxes If They Earn Over

Getting Paid On Venmo Or Cash App There S A Tax For That Los Angeles Times

Venmo Zelle Paypal Apple Pay And More Best P2p Services

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

Does The Irs Want To Tax Your Venmo Not Exactly

Venmo Vs Zelle Vs Cash App Abc27

Everything To Know About Venmo Cash App And Zelle Money

Despite A Late Start Bank Owned Zelle Moves More Money Than Venmo And Cash App Combined

If You Use Cash App Venmo Zelle Or Paypal You Should Watch This Video I Received Money From Cash App Venmo And Paypal Should I Declare Them For Tax Purposes

What S New For Family Child Care Providers Who Use Electronic Payment Apps Taking Care Of Business

Irs Cracking Down On Businesses Which Use Cash Apps Transactions Localmemphis Com

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

New Irs Rule Reduces Income Reporting From 20000 To 600 For Paypal Venmo Cashapp Zelle Others

Tcd Dearborn News Reminder Apps Like Venmo Zelle Cash App And Paypal Make Paying For Certain Expenses A Breeze But A New Irs Rule Will Require Some Folks To Report Cash

Irs Taking A Closer Look At Income Obtained From Venmo Cash App Zelle And More The Owensboro Times

Get Paid Through Peer To Peer Apps Watch Out For This New Tax Rule Inc Com